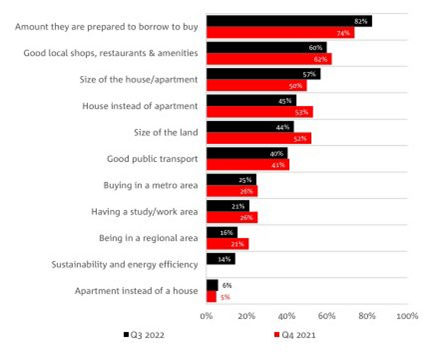

Given the rising rate environment, it’s unsurprising that borrowing capacity tops the list of what’s most important when purchasing a home, according to the latest NAB residential property survey.

The survey found 82% of property professionals believe borrowing capacity is now the most important factor for buyers, up from 74% a year ago (before interest rates started rising).

While everyone’s situation is different, a PropTrack analysis found an interest rate increase of 1 percentage point could lower a household’s borrowing capacity by 10%, based on a $1 million mortgage. The cash rate is currently 2.60% (an increase of 2.50% since May), which is the highest the cash rate has been since July 2013 when it was 2.75%. This has resulted in borrowing power reducing by approximately 25%.

Want to buy a property but concerned you won’t be able to borrow enough? Then speak to a mortgage broker.

Each lender has its own method of assessing your borrowing capacity, which means it can vary significantly from bank to bank. So it’s vital you choose to apply with the right one.

A good broker will know which lenders are suitable for someone with your unique circumstances.

Looking for an award-winning mortgage broker in Sydney? Fast Track Financial Group has over 130 five-star Google reviews and a very strong reputation. Book a consultation with out loan broker to learn more about your options.